I love the pinball machine...the only video arcade machine that I've ever enjoyed playing...maybe the action of drawing back on the pinball pulley and watching it spring forth and whack the ball out and into the action reminds me of the 9:30 a.m. stock market bell...then, it's just me and the machine and the paddles...

Since today marked the end of the third quarter for the markets, I thought I'd put up some charts depicting quarterly and yearly timeframes.

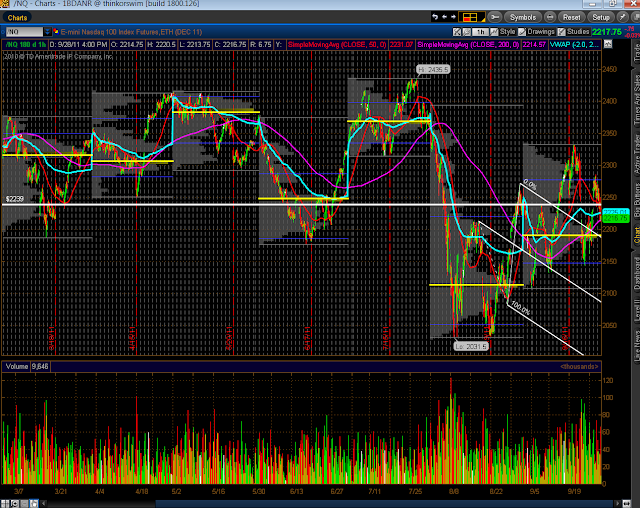

First, however, the 4-hourly chart below of the TF shows the "pinball" action that has occurred in each quarter this year. July was quite a decisive month...one month out of nine where it actually trended...more like plunged in one direction. This was also the case for the YM, ES & NQ.

If you look at the Quarterly chart below of the Russell 2000, you can see how much of the profits that were made in 2010 and 2011 were blown away in the third quarter...but actually most of it in July...timing is everything, eh! The next major level of support sits around 550.

The Yearly chart below of the Russell 2000 depicts a "dark cloud cover" candle formation so far for 2011...a very bearish pattern...however, with 3 months left in the year, anything can happen. It may be worth noting that the long bottom tail on the 2009 candle has never been retested...perhaps that will happen within the next year or so...we certainly have the present global economic, financial, social, and political climate brewing for that to occur.

Below are a Quarterly chart and a Yearly chart for the Dow 30...similar comments apply to the Dow as mentioned above for the Russell. The next major level of support sits around 10000.

Below are a Quarterly chart and a Yearly chart for the S&P 500...similar comments apply to the S&P as mentioned above for the Russell. The next major level of support sits around 1050.

Below are a Quarterly chart and a Yearly chart for the Nasdaq Composite...similar comments apply to the Nasdaq as mentioned above for the Russell. The next major level of support sits around 2100.

Now, if only a quarter would pay for a game of pinball...