* See UPDATES below...

These articles regarding ESG caught my eye. ESG is the acronym for environmental social governance.

They explain:

- its purpose,

- its founders/regulators/managers and influencers/advocates/minions,

- its implementation, and

- its subsequent disturbing and negative impacts to and destabilizations of world economies, global investment and pension funds, foreign and national security issues, natural environments around the world, and societies, in general, which have become exacerbated ten-fold and are now trapped within the tangled web of choking ESG policy.

These revelations have now surfaced and are being exposed as a result of the Russian war in Ukraine...and they're not pretty.

I've written numerous articles on President Biden's policies and agenda, which are tied in with ESG prescriptive policies, ever since he took office on January 20, 2021. You can read them at this link...and they're not pretty, either. This ZeroHedge article is, especially, not pretty.

As an aside, does anyone know exactly what Joe Biden's foreign policy is...apart from appeasement and deference toward dictators, invoking the perception of weakness? I haven't heard him outline one, to date.

By the way, aggressors eventually tire of weak leaders, as they begin to outlive their usefulness, and cast them aside in their quest for dominance...the alliance involving China, Russia and Iran against the U.S. and the West comes to mind.

On that front, Biden is:

- actively negotiating with Iran, using Russia as his intermediary, to re-enter the Iran Nuclear Deal and buy oil from them (which is at variance with ESG objectives), instead of developing America's oil and gas production to become energy-independent once again, as it became under former President Trump...(at what cost to America?),

- pushing ESG and developing wind and solar products to replace the use of cheaper fossil fuels for energy in the U.S. (which is at variance with ESG objectives)...for that, he'll need to buy many of the materials, components and fabrications from China...(a very expensive prospect for American taxpayers),

- approaching Venezuela's dictator to buy oil from them (which is at variance with ESG objectives)...(at what cost to America?),

- and is attempting to speak with Saudi and UAE's leaders to also buy oil from them (which is at variance with ESG objectives)...(at what cost to America?).

None of this makes sense.

No doubt, at some point, Joe Biden will outlive his usefulness to them...weak leaders serve no long-term purpose. How soon that would happen is anyone's guess.

Interestingly enough, I heard a theory that, for many years, the Russians have been covertly behind the push toward global green energy at the expense of fossil fuels, in order to, ultimately, weaken countries' national security systems. If true, that would explain the current chaotic state of affairs and negative impacts of ESG that countries are facing now...and account for the major dilemmas they are trying to deal with because of their adoption of this idealogy at the expense of their own energy independence and national security responsibilities.

ZeroHedge excerpt

President Biden may be "unwittingly supporting the worst humanitarian abuses in the world," but surely someone in his administration must be aware of the disturbing issues described in the following report...how about John Kerry, his so-called US Special Envoy for Climate?

If not, why not?

If so, why wouldn't the President know?

Meanwhile, Energy Secretary Jennifer Granholm laughed when asked on November 5, 2021 about Biden's plans to increase oil production and lower the cost of gasoline. She joins VP Kamala Harris in tasteless responses to serious questions in the form of laughter...all such a big joke to them. 😕

So, is ESG a fraud? Is your life better now as a result of its implementation...more prosperous...healthier...more stable...happier...more promising...more free from regulations...more secure against domestic crime and foreign wars?

Do some navel gazing, check your wallet and your pulse, then you be the judge...then, let your politicians, Wall Street market makers, and corporate CEOs know your answer.

By the way, U.S. mid-term elections are coming up in November, so Americans may also provide their answer at the ballot box...so, we'll see if a big Republican red wave rolls in to sweep Democrat control out of the House and Senate.

In my post of February 9, 2019, I warned against the foolish adoption of the Democrats' newly unveiled "Green New Deal" policies. It looks like my warnings had merit...and that Democrat House Speaker Nancy Pelosi was 'persuaded' to run with that agenda (which she'd sarcastically dubbed the "Green Dream," but, which has now become their "Black-Hole Nightmare").

So far, the polls have Biden's approval rating well under water at 37%...and that can get much worse until then...especially since no one believes his and the White House press secretary's "spin" and contradictive statements (lies) on the question of his restriction of domestic oil and gas production, including his cancellation of the permit to finish construction of the Keystone XL pipeline from Canada into the U.S. on Day One of his presidency.

BAD NEWS for ESG and its proponents/cronies/influencers.

P.S. If the following information is accurate, Biden's ESG policy could lead to another crisis, unless he adopts a complex strategic energy supply agenda (which includes cyber-attack prevention), but I'm not so sure he's intellectually capable of such planning, even if he were willing.

BAD NEWS for Americans.

MY PRESCRIPTION...A HEALTHY DOSE...

If I'm capable enough of figuring all of this out on my own, surely everyone else is, too. All it takes is a healthy dose of common sense!

* UPDATE March 11...

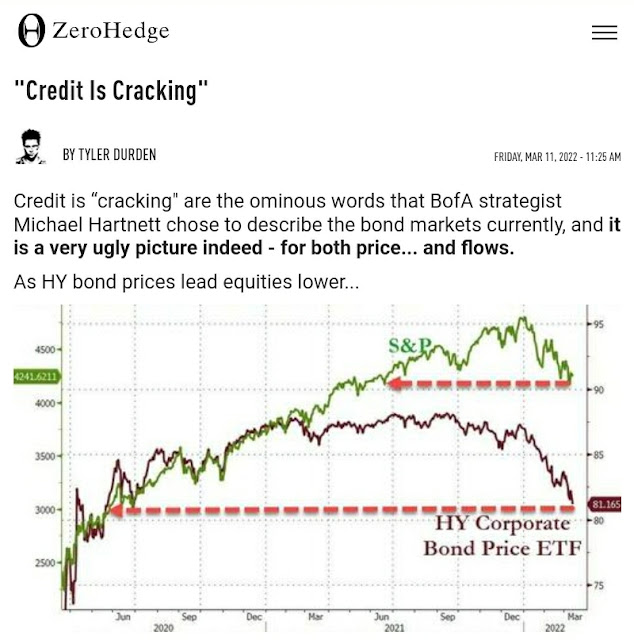

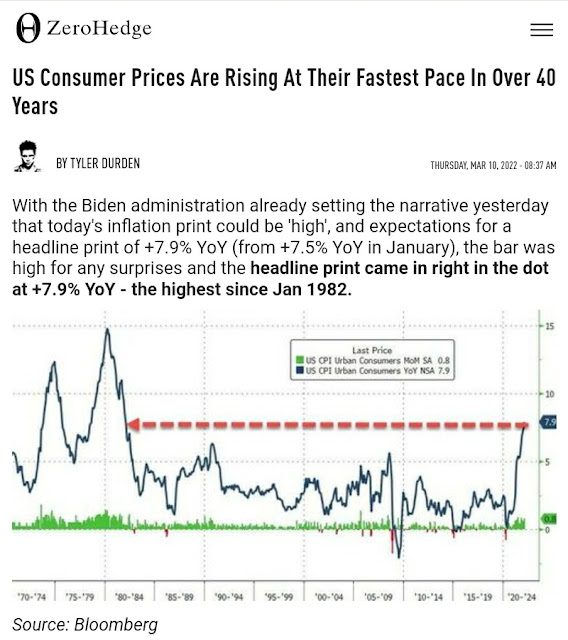

If you still think that inflation is "transitory," you will be in for a nasty surprise...this article spells out why it's not.

It looks like things will only get much worse from here. Global political and economic bifurcation has begun.

ZeroHedge excerpt

* UPDATE May 21...

Elon Musk, Tesla CEO: "ESG is a scam."

Stuart Kirk, global head of responsible investing, HSBC Asset Management: "some nut job has always told him the end of the world is nearing."

* UPDATE May 23...

A must-read on the dangers of ESG on prosperous capitalist democracies...

* UPDATE June 21...

So, why are they pushing the use of windmills? Makes you wonder...

More political insanity on display...a must-watch video to finally get to the truth...

* UPDATE July 18...

No one should be surprised...what did they expect, anyway? Stupid people create stupid things which create disastrous results! 😕

Stop electing stupid people to political office!

* UPDATE July 19...

ESG stocks are underperforming and are being dumped...investors may return to a new type of "sin stocks"...

ZeroHedge excerpt

* UPDATE July 20...

Pure insanity!

Welcome to Joe Biden's woke-'n-broke America!

Why is this a good idea and how is this contributing to a stable employment environment?

* UPDATE July 24...

ESG is simply a form of global "social justice injustice" racketeering.

Which global elites are profiting from this punitive practice and who is this hurting/punishing?

* UPDATE Aug. 2...

"Transitioning" to so-called reliable "green energy," (while banning fossil fuels at breakneck speed)

- LEADS TO

- power grid instability

- WHICH LEADS TO

- power grid blackouts

- WHICH LEADS TO

- rebalancing supply and demand

- WHICH LEADS TO

- inflation

- WHICH LEADS TO

- recession/depression

- WHICH LEADS TO

- heightened risks to national security

- WHICH LEADS TO

- a catastophic global energy crisis

- WHICH LEADS TO

- economic/social ruin

- WHICH LEADS TO

- famine

- WHICH LEADS TO

- war

- WHICH LEADS TO

- obliteration of all human life on the planet.

Who are the geniuses who thought that "inflicting a little transitory pain" on the middle and lower class segment of the human race during their reckless "energy transition," thereby creating a monstrous world-wide disaster, would be a great idea? 🤔

Shameful, outrageously stupid and self-destructive!

* UPDATE Aug. 8...

The growing global threats posed by China -- militarily, economically, financially, ecologically, environmentally (ESG), human rights abuses, global supply chain disruptions/blockades, etc. -- are described and discussed in detail in the following Life, Liberty & Levin video...

* UPDATE Aug. 14...

The 'not-so-hot' findings against solar panels...

It looks like it's only the rich 'early-adopters' segment of the population who may be currently interested in buying an electric car, based on the following hard truths...

* UPDATE Aug. 17...

So, the world was 5-7°C hotter in 1540 than today...and was not subject to the same man-made carbon emissions that scientists claim are responsible for current temperatures (which have risen less than 1°C in the past 100 years according to the NOAA...National Oceanic and Atmospheric Administration).

So, what gives? 🤔

* UPDATE Aug. 22...

Don't count on a cheap and readily-available supply of EV batteries and solar panels from China any time soon...

* UPDATE Aug. 24...

A number of banks have been banned from doing business with Texas because of their "hostile" and biased practice of financing ESG-related projects, while refusing the same to fossil fuel producers.

We'll see if this action spreads to other states. 🤔

* UPDATE Aug. 27...

BEWARE of the harmful and toxic environmental impacts and depletion of valuable and scarce water sources caused by mining lithium, required for the production of EV and other batteries.! 👀

* UPDATE Sept. 2...

First, California Governor Gavin Newsom mandates that ALL vehicles sold in his state must only be electric by 2035.

Then, a few days later, he warns California residents NOT to charge their electric cars from 4:00 - 9:00 pm because their outdated power grid can't handle it and would cause power blackouts!

What a joke! 🤔

* UPDATE Oct. 23...

US Banks are under investigation by 19 state Attorneys General for their lending and investment prejudices regarding ESG policies...(reportedly, JPM, BAC, C, GS, WF & MS...several of my relevant recent posts concerning these banks can be found here and here).

ZeroHedge excerpt

ZeroHedge excerpt

* UPDATE Oct. 31...

So, it really is all about the bottom line...ESG-investing may just be a passing fad, after all, and not a "real thing." 🤔

* UPDATE Nov. 5...

The implementation of ESG criteria by companies may be illegal...for several reasons...

ZeroHedge excerpt

* UPDATE Dec. 2...

Important Twitter thread on ESG...

N.B. For more details on BlackRock Inc., see my post of October 15.

* UPDATE Dec. 2...

The global "electric car czars" haven't got a clue as to what they're doing, as evident in the following reports...

* UPDATE Dec. 8...

It remains to be seen just how far Vanguard pushes away from the NZAM climate initiatives, as it exits from that financial alliance...

Its stock, AVD, has had difficulty holding onto and adding to gains above 20.00, since January 2006, as shown on the following monthly chart.

It's currently stuck in a consolidation zone between 20.00 and 25.00.

If the company now focuses on smart, sound investment strategies and solid gains for its clients, instead of NZAM's restrictive agenda, AVD may eventually break and hold above 25.00...and build on those gains, to portray Vanguard as a company of strength and one worthy of new investment money.

Otherwise, I'd expect to see it languish in its consolidation zone, or even drop back into a larger chaos zone between 12.00 and 20.00.

* UPDATE Dec. 21...

More investment banks, etc., are becoming wary of pushing ESG investment over oil and gas, as lawmakers eye antitrust violations...and as energy security is paramount above that of the climate, at the moment...

* UPDATE Feb. 5, 2023...

Investing in Biden's ESG-touted funds will, apparently, harm two-thirds of America's retirement accounts.

Not only that, his Department of Labour's new "rule" is, apparently, illegal and was done without changes in the law by Congress...and is currently the subject of a massive 25-state lawsuit against the Biden administration and this rule.

Make sure you do your own due diligence before you hand over your money to any investment management firm (or allow your pension fund to be used in this manner) and ensure they are MAXIMIZING...NOT MINIMIZING your returns under their foolish (politically-driven) investment agenda and practices.

* UPDATE Feb. 6...

Millions of dollars have been lost by companies in the "green energy" sector, as well as millions of birds (dead) from wind farms.

Off-shore wind farms operating in ocean waters are also suspected of killing whales and fish.

What a farce and complete economic and environmental disaster world political leaders have created, while promoting this technology!

They need to be held accountable.

* UPDATE March 4...

Power shortages are likely coming in the U.S. thanks to the Biden administration's restrictive policies (war) on the fossil fuel energy industry.

This comes just as Joe Biden puts further strains on the power grid by insisting that Americans drive expensive electric cars/trucks/motorcycles/ATVs, etc. AND taxing them to subsidize the growth of the Democrats' so-called "green energy" industry. By the way, how are they going to dispose of the millions of existing gasoline-powered vehicles (and gas-powered devices, such as lawn mowers, etc.) in a way that won't damage the environment?

Why are these politicians sabotaging America's energy security and independence AND ruining the environment, which was protected and enhanced under the Trump administration?

The stupidity in Washington is unbelievable!

* UPDATE March 10...

It's about time that governments came to their senses! 😒

But, what will they do about this "new-found realization" and how will they undo the (economic and ecological) damage they've already caused by their actions, so far?

By the way, the damage already done is laid out in the following article...

* UPDATE March 26...

Politicians never were known for being smart...in fact, they have no idea what they are doing when it comes to pushing wind and solar energy to achieve Net Zero...😕

"When fluctuations in wind speed are taken into account in Allison's formula, the performance of wind becomes very much worse. If the wind speed drops by half, the power available falls by a factor of eight. Almost worse, he notes, if the wind speed doubles, the power delivered goes up eight times, and the turbine has to be turned off for its own protection." -- ZeroHedge excerpt

"Whichever way you look at it, wind power is inadequate. It is intermittent and unreliable; it is exposed and vulnerable; it is weak with a short life-span." -- Professor Allison

* UPDATE March 31...

Reality about the viability and legality of ESG-related rules for companies in which they invest, is beginning to set in on investment firms, such as BlackRock, as detailed in the following ZeroHedge report.

* UPDATE May 6...

The climate zealots cannot forecast what effects their edicts will resolve/produce on global temperature...they have no clue what they're doing in that regard, except bankrupting their countries in the process!

$50 Trillion "climate grift," indeed! 🤔

* UPDATE May 12...

Federal Reserve Governor Waller says the matter of climate change "does not merit special treatment" in their supervision of the U.S. financial system, as it "does not pose a serious risk to the safety and soundness of large banks or the financial stability of the U.S"....and, instead, they "should focus on more near-term risks in keeping with out mandate."

So, if the Fed is not concerned about climate change related to the financial system, why would banks insist that their loans be prioritized for companies catering to so-called "green-energy projects?" How is that a fair or ethical business practice?

* UPDATE May 23...

Global climate zealots' "green dreams" just became "black-hole nightmares," with outrageous cost overruns looming for green-energy projects projects that will crush thriving economies and grind them into the massive money pits that are being dug with reckless and breathless abandon.

I can hear the metal rusting already on the blades of gigantic wind turbines that stand within their unfinished grids...waiting...and waiting...and waiting to be put to use.

* UPDATE June 3...

Wouldn't it be interesting to know if those who are pressuring or forcing these companies to achieve high DEI (diversity, equity and inclusion) and ESG scores are also shorting their stocks? 🤔

* UPDATE July 21...

Financial data indicates that money in ESG funds have been flowing out, inasmuch as they fail to deliver better performance than non-ESG funds.

Will the ESG-investing mania disappear? Time will tell...perhaps it depends on the political party and President in power at that time...or, perhaps it's simply related to ROI (return on investment).

* UPDATE August 9...

More 'boom-and-bust heists' emerge under President Joe Biden's 'leadership'...this time involving electric vehicles, which he's been pushing ever since he took office in 2021, concerning his non-stop climate-hysteria agenda.

He can now add another notch in his ever-expanding belt comprised of failed policies.

When is "enough" enough for voters??? 😕

* UPDATE August 30...

More "green energy" disasters strike...as the world's largest offshore wind-farm developer's profits get blown away, as investors dump its stock, in droves, as described in the following article.

When will overpaid and underqualified world leaders and their silly "climate czars" finally admit that their reckless so-called "green-energy" solutions have failed spectacularly...and it's their citizens who've suffered immensely, as a result of soaring energy prices, foreign supply-chain non-fulfillments, power blackouts and out-of-control inflation!

* UPDATE Sept. 9...

The inverse ETF of companies following 'woke' ESG policies is coming this year...it will trade under the ticker GWGB...we'll see what happens.

Either way, it should be interesting to see whether the tide is turning against ESG, and, if so, how fast.

One to watch in terms of velocity of uptake and price movement.

* UPDATE September 27...

It looks like "climate change" is not such an emergency, after all...

* UPDATE October 5...

If this mega deal goes through, it looks like fossil fuel energy will still be going strong in the United States...

* UPDATE October 11...

A takeover agreement has been reached and Exxon's mega deal will be concluded.

More details on market reaction here.

ZeroHedge excerpt

* UPDATE October 28...

The "green energy myth" is imploding, as is evident in the following articles...

ZeroHedge excerpt

* UPDATE November 1...

"The renewable energy bubble is in meltdown" -- as more projects are cancelled -- crippling Joe Biden's green energy "Bidenomics" plan.

* UPDATE November 10...

More green energy meltdowns...

* UPDATE November 17...

A common sense approach to energy...

* UPDATE November 25...

This is why people don't trust money-grubbing elite political climate zealots...

* UPDATE November 26...

Money talks...and in 2022 and 2023 it's saying that ESG investing is a con game...

Source: ZeroHedge* UPDATE November 27...

Well...well....well...so, no need to panic over carbon emissions...and no need for climate zealots to continue their useless gatherings to fabricate more lies to extract their pound of flesh from taxpayers by claiming that their measures will reduce temperatures around the world...

* UPDATE November 30...

Joe Biden's EV push is too costly for vehicle manufacturers and is back-firing...big time...

EVs causing more problems than gas-powered vehicles are not a good incentive for people to rush out and buy them...

* UPDATE December 3...

"In the final analysis, green investing has to be based on economic realities."

Joe Biden's ESG-based idealogical green energy mirage is imploding...and has cost investors billions of dollars.

ZeroHedge excerpt

* UPDATE December 19...

So, buyers beware when 'investing'...

* UPDATE December 20...

More EV startup companies bite the dust...

* UPDATE December 23...

The high cost of foolish climate zealotry...

* UPDATE March 30, 2024...

Money (or lack thereof, by way of dwindling green energy investments) talks...

* UPDATE April 3...

As more money disappears from the bottom line of companies employing self-destructive DEI and ESG idealogy, their executives are dropping them like hot potatoes...money talks!

* UPDATE May 4...

BEWARE the 'solar panel installation and lack of follow-up-servicing' scam...

* UPDATE May 11...

Who are these "geniuses" who think up these stupid ideas?

Oh, wait...they're politicians, pressured by professional activitists and agitators...likely with "skin in the game!"

* UPDATE June 29...

A "much-needed reality check" on different forms of world energy usage is well laid out in the following article.

It seems that the use of hydrocarbon-based energy sources is still growing faster than wind and solar combined...wind generation fell in 2023 despite adequate capacity because the "wind didn't blow."

ZeroHedge excerpt

* UPDATE June 30...

The "ultimate uncertainty" for the future of electric vehicles is becoming clear, inasmuch as almost half of existing EV owners said they would not buy another one and want to go back to gas-powered vehicles.

Score another loss for American taxpayers who funded EV rebates, etc., under Joe Biden's reckless and failed policies/mandates related to EVs, climate initiatives and ESG programs.

ZeroHedge excerpt

* UPDATE July 13...

Joe Biden's and Democrats' "Big Green Grift" will become extinct in the next several years, as it will be inadequate to generate the electical capacity needed to power AI data centers in the U.S. (which will require "a lot of fossil fuels and a lot of nuclear").

This confirms that the President and his minions, who've been funding and implementing mandating their restrictive and socialistic policies, are sorely lacking in innovative forward-thinking capabilities.

* UPDATE July 17...

More and more major companies are dumping Joe Biden's absurd and costly ESG/DEI policies...whose fate now mirrors that of the dinosaurs...

~~~~~~~