* See UPDATES below...

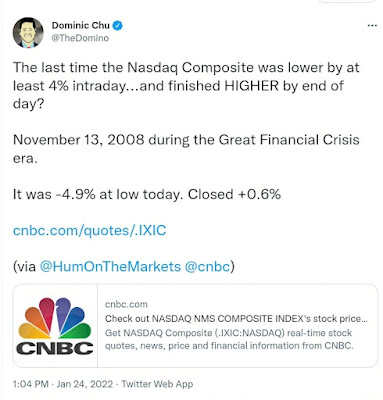

The SPX had a wild ride today, with an intraday trading range of 194.7 points, complete with a gap down on the open, followed by a huge drop lower, and finally followed by a massive rally to close the day a bit higher than Friday's close, as shown on the following daily chart.

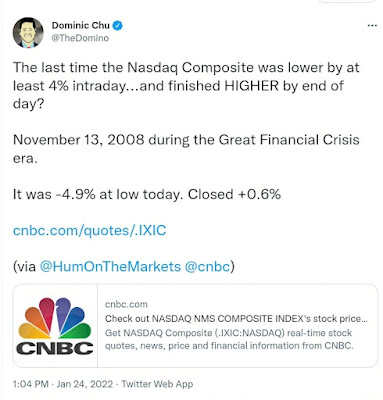

This volatile action triggered some interesting tweets...

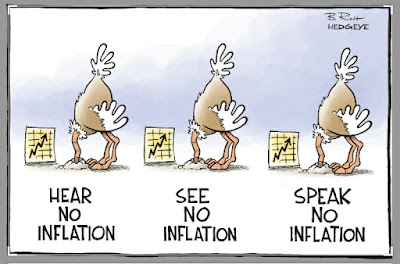

...and has created an "interesting" dilemma for the Federal Reserve to digest as they examine their next moves at their upcoming meeting this Wednesday.

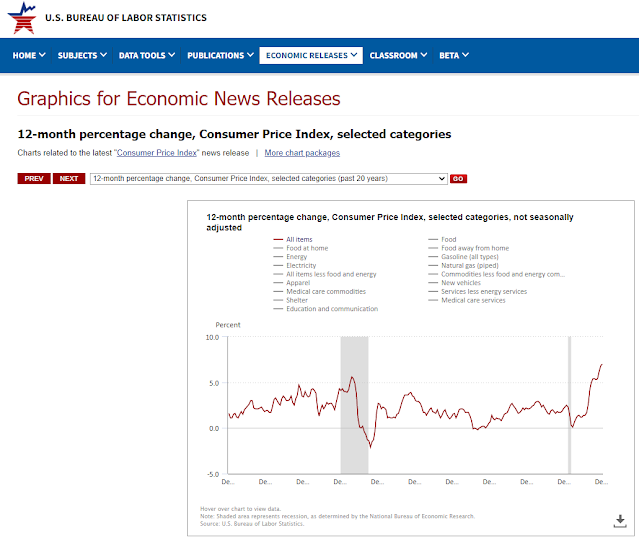

However, I can't see this influencing their dual mandate to maintain a 2.0% inflation target and stable prices (the U.S. inflation rate is already well above at 7.0% with no signs of abating) and to promote maximum employment (the current unemployment rate is 3.9%).

Their current interest rate is 0.25% and is not a deterrent to curb out-of-control inflation.

If today's intraday volatility does unduly influence them, they're not performing (what should be) their impartial job of properly managing their dual mandate, in my opinion.

* UPDATE January 26...

The Fed has failed to carry out their dual mandate, once again...inflation will continue to rage.

Not hiking interest rates now is foolish and signals to investors and the rest of the world that the U.S. economy is too weak to withstand higher rates.

Therefore, this does NOT justify higher equity prices, in my opinion

They will have to revert to drastic measures soon to make any meaningful dent in out-of-control inflation, because they've waited far too long. They should have stopped their bond-buying spree and begun to raise rates months ago.

Morning comments made prior to the FOMC statement indicate a growing concern over the Fed's lack of leadership in calming inflation...President Biden has already thrown Chairman Powell under the bus on this issue.

However, the President is not without blame in contributing to inflation. He needs to:

- REVERSE his executive actions when he (1) restricted oil and gas exploration and drilling on federal lands and imposed further regulations on that industry, and (2) withdrew the approval of the Keystone XL pipeline from Canada...those two actions on Day One of his presidency triggered and contributed to the inflation spike.

- STOP paying people to stay home and to get back to work.

- STOP flooding the economy with fiscal stimulus programs and exploding the national debt (now at $29.88 Trillion).

- START implementing policies that tighten national security, rather than continue with those that are weakening it...e.g., resume building the southern border wall and enforce existing immigration laws.

Both men need to start doing their jobs properly...otherwise, a GOP majority win in both the House and Senate is guaranteed in the November mid-term election.

However, with Biden's overall approval rating already in the 30's because of his reckless actions (Afghanistan), and his radical socialist policies and agenda, a massive GOP win is likely to occur, anyway.

* UPDATE January 27...

It seems as though it doesn't really matter to Chairman Powell that inflation is hitting lower-income people hard...so, who's looking out for them and, really, what use is the Fed? 😕

Expect:

- the market chaos to continue,

- the lower class continue to suffer under crushing inflation,

- the Misery Index continue to rise, as described in my post of January 26,

- while the Fed and the President "fiddle and fluff over" the harsh results/realities of their actions/inactions.