This video speaks for itself...

WELCOME

Dots

Loyalty

ECONOMIC EVENTS

UPCOMING (MAJOR) U.S. ECONOMIC EVENTS...

*** CLICK HERE for link to Economic Calendars for all upcoming events.

Tuesday, June 22, 2021

Spectacular Political Flip-Flop Faux-Pas Moments...Brought To You By U.S. Senate Democrats

Monday, June 21, 2021

Biden's 'PPT' Activated?

If true, it's too bad that Biden doesn't spend his time to micro-manage the southern border crisis that he created, instead...and allow the 'free' markets to carry on freely, without political interference.

Sunday, June 20, 2021

PRICE ALERT: SPX:VIX Ratio

Further to my post of June 11, the SPX:VIX ratio has drop to just above the 200 level...a major resistance/support level, as shown on the daily ratio chart below.

This follows a recent new swing high in price to just above 250. Ratio price has failed, repeatedly, to remain above 250 over the years.

All three technical indicators, RSI, MACD and PMO, formed divergences on this latest price swing high, hinting at ensuing price weakness. After making a new all-time high of 4257.16 on June 15, the SPX dropped sharply and closed at 4166.45 on Friday.

Furthermore, the RSI has dropped below 50, and the MACD and PMO have formed bearish crossovers, all signalling further weakness ahead.

A drop and hold below 200 could send the SPX down to around 4100, or lower to 4000...particularly if the ratio drops and holds below its next support level of 150 (the 200 MA sits at 173.43, so failure of price to hold that level will see major selling follow in the SPX).

Major historical support on the ratio sits at 100, which, up until the year 2000, represented major resistance during the 1990s. A drop and hold below that level would likely result in panic selling in the SPX, as we saw during the 2008/09 financial crisis [refer to the longer-timeframe monthly chart of the SPX (with SPX:VIX ratio displayed in histogram format) shown in my above-mentioned post for context].

Sunday, June 13, 2021

The Subversion of Women By Joe Biden's 'Woke' White House

I dedicate this post in memory of my dear Mom, who devoted her life to helping and advancing young women throughout her long and humble career.

The irony I laid out in my post of January 23 seems fitting, inasmuch as President Biden's White House has now replaced "mother" with "birthing person"...allegedly to be 'more inclusive' to people.

"Truly, the greatest trick the patriarchy has ever pulled was convincing liberals that stripping women of the things that make them unique to appease trans men is somehow the progressive and 'inclusive' thing to do." -- Washington Examiner

This goes hand-in-glove with Biden's support of biological boys and men being allowed to compete in girls and women's' sports...and to enter and use girls and women's bathrooms and locker rooms.

This is very insulting, disrespectful, demeaning, misogynistic, sexist, subverting, cruel, and dangerous to girls and women, in my opinion. Are they trying to wipe out women's existence altogether, with all of their 'woke gender-neutral' terminology and policies?

However,

- House Speaker Nancy Pelosi's Twitter profile still refers to her as a mother and grandmother,

- Joe Biden's profile refers to him as a husband, father and grandfather,

- Jill Biden's profile refers to her as a mother, grandmother and wife, and

- Kamala Harris' profile refers to her as a wife, momala and auntie.

In the name of equality, will "father" be replaced by "sperm vessel?" 😒

This idiocy should be called out for what it is...the perversion/bastardization of the English language.

Women and girls are not robots! How dare they pull these subversive stunts!

By the way, at what point does this nonsense become a national security threat?But wait...there's more...thanks to various assertions made by Democrats over the years...

Somebody else has noticed that Democrats are trying to erase "women"...

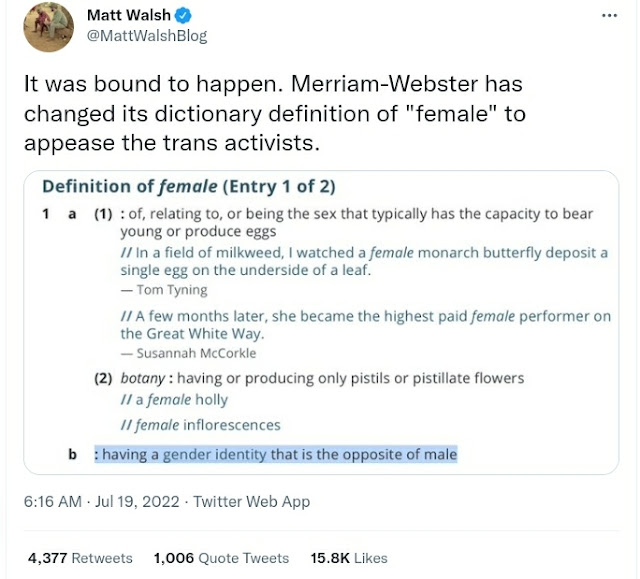

So, why hasn't Merriam-Webster redefined "male?" 🤔 What a sexist slap in the face to women! And, why aren't so-called feminists speaking out against this crap?

It's clear that the Democrat party is a patriarchy, hell-bent on debasing women, based on the following stupid and cruel nonsense...😕

Saturday, June 12, 2021

Inflation...Transitory Or Permanent? HINT: Bubblegum

- Economic theory is irrelevant.

- There are factors affecting inflation.

- But these factors are unpredictable.

- So, inflation projection could go up or down on a variety of modelling scenarios.

SB's "Weekend Bits & Bites" 😏

Stay cool...😎

* UPDATE June 16...

The Geneva, Switzerland U.S./Russia 'sunglasses' summit took place today between President Biden and President Putin...where it was merely a 'talk about more talks.'

So, what gifts did Putin get from Biden?...sunglasses, a pipeline to Europe, sanctions lifted, a return of Russian diplomats to the U.S., a list of 16 U.S. critical infrastructure entities that are 'off-limits' to cyberattack by Russia (does that mean that everything else not on the list is OK to be attacked?...bizarre!), and the opportunity to answer dozens of questions from reporters and spew his propoganda on international TV for 55 minutes at the conclusion of the summit without challenge by Biden, because he wasn't at that solo press conference! Why not, Joe?What gifts did Biden get from Putin?...nothing...and the 'privilege' of being the 'second act' to Putin in his 20-minute scripted solo press conference that followed, taking pre-screened questions from only 5 reporters...and the humiliation of being the 'bridesmaid,' not the 'bride.'