* See UPDATES below...

I added the following update today in my post of July 26 pertaining to the MSCI World Index:

To that, I'd note that it's still a bear market for the SPX (currently below its 50 MA) on a weekly timeframe (until it makes a higher swing low and higher swing high), as shown on the following chart.

A drop and hold below the 50 MA on the following weekly chart of the SPX:VIX ratio could signal that we'll see another leg down on the SPX.

For further clues on such a possibility, keep an eye on the following daily chart of the SPX:VIX ratio.

If price drops and holds below its 200 MA, if the RSI drops and holds below 50.00, and if the MACD and PMO form and hold bearish crossovers, we'll see the SPX drop, possibly to a new weekly swing low, especially if a bearish Death Cross reforms and holds on the SPX:VIX ratio weekly timeframe.

* UPDATE Aug. 22...

Noteworthy today...as at 1:11pm ET:

- the SPX has gapped down on the open and plunged to well below last week's low, as shown on the weekly chart,

- the SPX:VIX ratio has dropped below both 50 and 200 MAs, as shown on the weekly chart,

- and the SPX:VIX ratio has dropped below its 200 MA, but is still above the 50 MA, the RSI has dropped below 50.00, and bearish crossovers have formed on the MACD and PMO, as shown on the daily chart.

We'll see if the SPX continues to weaken, along with the SPX:VIX ratio, as traders await Fed Chairman Powell's remarks on Friday at the annual Jackson Hole Economic Policy Symposium for any hints of upcoming interest rate hikes, either more hawkish or dovish than anticipated.

However, I seem to recall that Chair Powell has not, typically, telegraphed the Fed's intentions on future rates in his previous Jackson Hole speeches...so, I wouldn't expect him to veer off course in this one.

P.S. The SPX closed at 4137.99, after making a low of 4129.86 today.

* UPDATE Aug. 26...

Fed Chairman Powell spooked U.S. markets with his unmistakable hawkish outlook for interest rates and the pain ahead for Americans and companies...

The SPX and other Major Indices plunged on the news...and closed at/near their lows of the day.

This may be the catalyst that begins the next leg down on the weekly timeframe, as outlined above.

SPX Daily

* UPDATE Sept. 3...

With approximately half of all U.S. companies anticipating that they will have to lay off workers over the next 12 months, and many Americans becoming homeless, President Biden should get busy and concentrate on fixing his broken economy (of his own making), instead of demonizing half of the country, as he did in his reprehensible speech on Thursday.

Joe Biden Speech Sept. 1, 2022

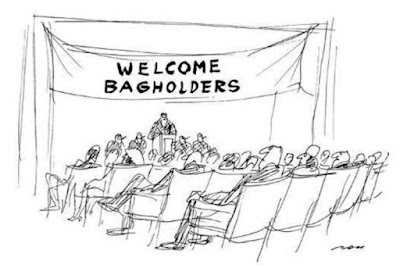

The stocks markets have erased all of their gains made since Biden took office on January 2021.

So, he's even ruined that segment of America with his out-of-control and debt-ridden spending packages.

The National Debt owed per taxpayer is nearly $245,000 and rising by the nano-second!

It seems that Joe's fond of red!

N.B. Until the President drastically changes course (a good start would be to unleash the oil and gas industry and drop his overly-restrictive regulations), trade with caution!