* See UPDATE below...

Over the years, I've posted numerous articles on equity bubbles bursting, at this link.

I can add another one to the list...Japanese SoftBank Group Corp. (SFTBY).

As shown on the following monthly chart, SFTBY hit its all-time high of 50.00 in February of 2021 and began its plunge the next month. It lost over 60% of its value by May 2022.

There has been no sustained advancement above its near-term support at 16.00 since its IPO in 2010.

Failure to hold above 16.00 could see it plummet in short order to 10.00, or lower.

SoftBank's reckless business investment risks and failures are described in the following article...

* UPDATE Aug. 13...

"...we had our heads in the clouds."

So, will that ailment be transitory, or permanent? 😏

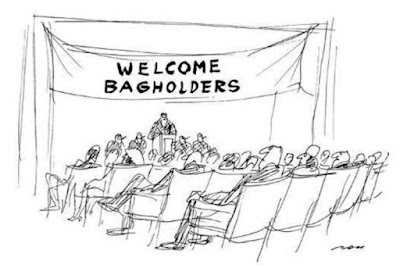

Bubbles are meant for baths! 😏