I last wrote about GOLD in my post of October 9th.

Price is slipping back to its critical triple-bottom support level of 1180, as shown on the 5-Year Weekly chart below. I'm watching for a break and hold below that level for a possible re-test of the 1000 level as I mentioned in that post...particularly if the SPX:VIX ratio breaks and holds above the 150.00 level, as I mentioned in my post of October 24th.

The Daily SPX:VIX ratio chart below shows price (as of Thursday's close) approaching the 150.00 level...however, the Momentum indicator is already approaching the 20-year extreme overbought level, once again.

So, the question of the week (and for the remainder of 2014) is, which of these two charts will be taken beyond their extremes and into a Santa rally or bust? Care to hazard a guess as to which one the Fed would support (translation: "permit")?

WELCOME

Welcome and thank you for visiting!

The charts, graphs and comments in my Trading Blog represent my technical analysis and observations of a variety of world markets...

* Major World Market Indices * Futures Markets * U.S. Sectors and ETFs * Commodities * U.S. Bonds * Forex

N.B.

* The content in my articles is time-sensitive. Each one shows the date and time (New York ET) that I publish them. By the time you read them, market conditions may be quite different than that which is described in my posts, and upon which my analyses are based at that time.

* My posts are also re-published by several other websites and I have no control as to when their editors do so, or for the accuracy in their editing and reproduction of my content.

* In answer to this often-asked question, please be advised that I do not post articles from other writers on my site.

* From time to time, I will add updated market information and charts to some of my articles, so it's worth checking back here occasionally for the latest analyses.

DISCLAIMER: All the information contained within my posts are my opinions only and none of it may be construed as financial or trading advice...please read my full Disclaimer at this link.

Dots

* If the dots don't connect, gather more dots until they do...or, just follow the $$$...

Loyalty

ECONOMIC EVENTS

UPCOMING (MAJOR) U.S. ECONOMIC EVENTS...

***2024***

* Wed. July 31 @ 2:00 pm ET - FOMC Rate Announcement + Forecasts and @ 2:30 pm ET - Fed Chair Press Conference

* Wed. Sept. 18 @ 2:00 pm ET - FOMC Rate Announcement + Forecasts and @ 2:30 pm ET - Fed Chair Press Conference

* Thurs. Nov. 7 @ 2:00 pm ET - FOMC Rate Announcement + Forecasts and @ 2:30 pm ET - Fed Chair Press Conference

* Wed. Dec. 18 @ 2:00 pm ET - FOMC Rate Announcement + Forecasts and @ 2:30 pm ET - Fed Chair Press Conference

*** CLICK HERE for link to Economic Calendars for all upcoming events.

Thursday, October 30, 2014

Friday, October 24, 2014

SPX:VIX RATIO -- The REAL Test for Bulls

I last wrote about the SPX:VIX ratio in my post of October 15th.

As shown on the 20-Year Daily ratio chart below, bulls have pushed the price back up to close out this week at major resistance around the 120.00 level. Failure to hold 120.00 could very well see price re-test the 60.00 level, or lower...watch for panic selling of equities should the 60.00 level be breached and held.

The REAL test for sustained market bullishness will be whether price can reclaim and hold the 150.00 level, which was a milestone level this ratio reached before succumbing to pressures of the 2007/08 financial crisis.

As shown on the 20-Year Daily ratio chart below, bulls have pushed the price back up to close out this week at major resistance around the 120.00 level. Failure to hold 120.00 could very well see price re-test the 60.00 level, or lower...watch for panic selling of equities should the 60.00 level be breached and held.

The REAL test for sustained market bullishness will be whether price can reclaim and hold the 150.00 level, which was a milestone level this ratio reached before succumbing to pressures of the 2007/08 financial crisis.

Tuesday, October 21, 2014

What do the SPX & WORLD Indices Forecast?

The following four 3-Year Daily charts show the relative strength/weakness of the SPX compared with the WORLD Index.

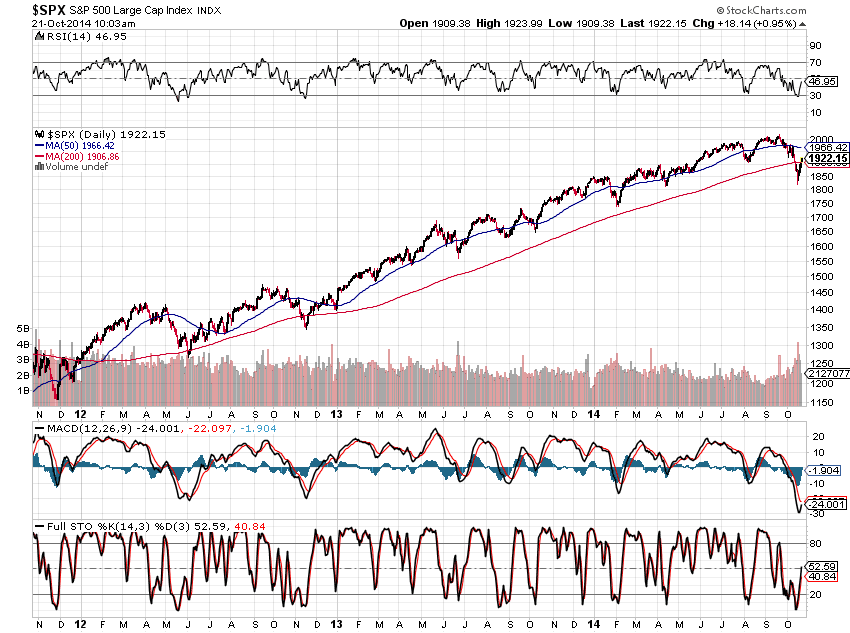

Chart #1 shows a fairly steady climb of the SPX during the past three years. Recent action in October has put in a lower low and broken the uptrend on this daily timeframe. Lower lows have also been made in all three indicators (RSI, MACD & Stochastics)...hinting of further weakness ahead.

Chart #2 shows a more difficult climb of the WORLD Index once it broke above major resistance in January of 2013. This market topped out in July of this year, lost all of its 2014 gains, along with much of its 2013 gains, and hasn't yet recovered.

It's hard to imagine that the SPX will operate under smooth, believable (realistic), and sustainable bullish conditions during the balance of this year and into next if conditions continue to deteriorate in the WORLD Index.

In this regard, watch for any strengthening of the WORLD Index versus the SPX over the coming days/weeks...or continued weakness...as depicted on the following two ratio charts of SPX:WORLD and WORLD:SPX.

No confirmation of a turnaround is indicated yet for the WORLD Index (see Chart #4) as the RSI and Stochastics Indicators are still below the 50% level; however, the MACD has crossed up and the MACD Histogram is above zero...hinting of a possible slowdown in its decline.

Chart #1 shows a fairly steady climb of the SPX during the past three years. Recent action in October has put in a lower low and broken the uptrend on this daily timeframe. Lower lows have also been made in all three indicators (RSI, MACD & Stochastics)...hinting of further weakness ahead.

|

| CHART #1 |

Chart #2 shows a more difficult climb of the WORLD Index once it broke above major resistance in January of 2013. This market topped out in July of this year, lost all of its 2014 gains, along with much of its 2013 gains, and hasn't yet recovered.

|

| CHART #2 |

It's hard to imagine that the SPX will operate under smooth, believable (realistic), and sustainable bullish conditions during the balance of this year and into next if conditions continue to deteriorate in the WORLD Index.

In this regard, watch for any strengthening of the WORLD Index versus the SPX over the coming days/weeks...or continued weakness...as depicted on the following two ratio charts of SPX:WORLD and WORLD:SPX.

No confirmation of a turnaround is indicated yet for the WORLD Index (see Chart #4) as the RSI and Stochastics Indicators are still below the 50% level; however, the MACD has crossed up and the MACD Histogram is above zero...hinting of a possible slowdown in its decline.

|

| CHART #3 |

|

| CHART #4 |

Friday, October 17, 2014

Bulls Will Need to Prove This Bull Market

As shown on the Daily chart below of the S&P 500 E-mini Futures Index (ES), price dropped this week through one support level of Fibonacci confluence and down to the next one before bouncing to finish the week just back above the first confluence level.

Volumes have been exceptionally high since last Friday. Whether the spike in volume on Wednesday's final drop is capitulation volume remains to be seen.

We'll need to see price hold above the 1850-1870 level and continue to rally and hold above the 200 MA (pink) around the 1900 near-term resistance level on increasing volumes...otherwise, any further rally may simply be a dead-cat-bounce...particularly since we now have a lower low and the Daily uptrend has been broken.

Failure to hold 1850 may see panic selling enter this market...especially if the SPX:VIX ratio drops below the 60.00 level on increasing downward Momentum, as I mentioned in my post of October 15th.

Volumes have been exceptionally high since last Friday. Whether the spike in volume on Wednesday's final drop is capitulation volume remains to be seen.

We'll need to see price hold above the 1850-1870 level and continue to rally and hold above the 200 MA (pink) around the 1900 near-term resistance level on increasing volumes...otherwise, any further rally may simply be a dead-cat-bounce...particularly since we now have a lower low and the Daily uptrend has been broken.

Failure to hold 1850 may see panic selling enter this market...especially if the SPX:VIX ratio drops below the 60.00 level on increasing downward Momentum, as I mentioned in my post of October 15th.

Wednesday, October 15, 2014

Panic Selling Ahead for Equities?

As of 2:00 pm today (Wednesday), and further to my post of October 9th, price in equities has plunged to the next major support level of 60.00, after failing to hold a critical level of 100.00, as shown on the 20-Year Daily ratio chart of SPX:VIX below.

Price on this ratio chart now sits at levels seen during the 2008 financial crisis. A break and hold below this level could, indeed, cause some panic selling in equities...one to watch very closely over the coming days/weeks!

I'll post an updated chart after the market closes today...check back here for the update.

Here's a shot of the same chart after today's close...

Here's a shot of a 60-Day 60-Minute ratio chart. The Momentum indicator (MOM) didn't make a lower low today than it did on October 10th...signalling a slowing of the decline of this ratio; however, it did from October 13th and 14th on today's action...signalling renewed strength of this decline over the past three days.

So, as I mentioned above, the 60.00 level would be an important level if breached (and held), especially if a lower low was made on MOM below that set on October 10th, and, particularly below the lowest low set on August 1st. The 100.00 and 110.00 levels represent near-term major resistance now and would need to be reclaimed and held before any great confidence returns on the buying side. This timeframe is also worth watching over the coming days for these reasons.

Price on this ratio chart now sits at levels seen during the 2008 financial crisis. A break and hold below this level could, indeed, cause some panic selling in equities...one to watch very closely over the coming days/weeks!

I'll post an updated chart after the market closes today...check back here for the update.

Here's a shot of the same chart after today's close...

Here's a shot of a 60-Day 60-Minute ratio chart. The Momentum indicator (MOM) didn't make a lower low today than it did on October 10th...signalling a slowing of the decline of this ratio; however, it did from October 13th and 14th on today's action...signalling renewed strength of this decline over the past three days.

So, as I mentioned above, the 60.00 level would be an important level if breached (and held), especially if a lower low was made on MOM below that set on October 10th, and, particularly below the lowest low set on August 1st. The 100.00 and 110.00 levels represent near-term major resistance now and would need to be reclaimed and held before any great confidence returns on the buying side. This timeframe is also worth watching over the coming days for these reasons.

Sunday, October 12, 2014

Double-Top Rejection at Triple-Fibonacci Resistance for Japan's Nikkei Index

It's been awhile since I wrote about Japan's Nikkei Index (NKD)...July 31st at this link.

After an initial drop at the right shoulder of a Head and Shoulders formation that was in play at the time, price rallied and has, once more, pulled back at the confluence of a double-top price level and triple-Fibonacci resistance level, as shown on the following Weekly chart.

Failure to hold its current level of 15,000 could, potentially, send price tumbling to around the 13,700 major support level, or even 12,600. Alternatively, watch for any increase in volumes on rallies...otherwise they may simply be dead-cat bounces, as has been the case since November of 2013.

After an initial drop at the right shoulder of a Head and Shoulders formation that was in play at the time, price rallied and has, once more, pulled back at the confluence of a double-top price level and triple-Fibonacci resistance level, as shown on the following Weekly chart.

Failure to hold its current level of 15,000 could, potentially, send price tumbling to around the 13,700 major support level, or even 12,600. Alternatively, watch for any increase in volumes on rallies...otherwise they may simply be dead-cat bounces, as has been the case since November of 2013.

Friday, October 10, 2014

Hanging Man Formation on USD/CAD Forex Pair

The 10-Year Weekly chart below of the USD/CAD Forex pair shows a bearish "hanging man" formation on this week's candle...signalling a potential weakening of the U.S. dollar against the Canadian dollar. Price hit the confluence of a major triple-top resistance level, 50% Fibonacci retracement level, upper Bollinger Band, and upper Channel last week.

A break and hold above 1.1277 could see price spike up to 1.1665 (which is the next Fibonacci resistance level), particularly if Canada's TSX continues its plunge, after closing today (Friday) at 14,227.36. Otherwise, there is some support around the 1.10 level should the Canadian dollar strengthen against the American dollar.

The following Daily chart of the TSX shows that price has closed at a major support level. A drop and hold below this level could see price continue down to around 14,000, or even 13,500 before it consolidates or bounces. The RSI, MACD and Stochastics indicators are all very oversold, but none have confirmed a turnaround in price yet.

Watch for any co-relation in price action in the coming days/weeks between the USD/CAD and the TSX for possible clues in direction on both.

A break and hold above 1.1277 could see price spike up to 1.1665 (which is the next Fibonacci resistance level), particularly if Canada's TSX continues its plunge, after closing today (Friday) at 14,227.36. Otherwise, there is some support around the 1.10 level should the Canadian dollar strengthen against the American dollar.

The following Daily chart of the TSX shows that price has closed at a major support level. A drop and hold below this level could see price continue down to around 14,000, or even 13,500 before it consolidates or bounces. The RSI, MACD and Stochastics indicators are all very oversold, but none have confirmed a turnaround in price yet.

Watch for any co-relation in price action in the coming days/weeks between the USD/CAD and the TSX for possible clues in direction on both.

Thursday, October 09, 2014

Triple-Bottom Bounce on Gold After Re-test of Critical Support Level

As shown on the 5-Year Weekly chart of GOLD below, price has bounced this week [as of today (Thursday)] at a triple-bottom major support level of 1180, which began in June of 2013.

This critical support level converges with the bottom of the weekly Bollinger Band, along with the lower edge of a large declining channel (which began after the all-time high of 1923.70 was made during the week of September 5th, 2011).

Failure to hold above the critical 1180 support level could see a much larger decline ahead, possibly to the 1000 level, as shown on the next 20-Year Weekly chart. Bulls will need to re-take 1300 and hold that level before we likely see any further serious commitment to, ultimately, reverse this long-standing downtrend on the weekly timeframe.

Volumes are very thin between 1100 and 1000, as shown in the Volume Profile along the right-hand side of the chart, so we could very well see 1000 re-tested before we see any significant buying enter the Gold market.

This critical support level converges with the bottom of the weekly Bollinger Band, along with the lower edge of a large declining channel (which began after the all-time high of 1923.70 was made during the week of September 5th, 2011).

Failure to hold above the critical 1180 support level could see a much larger decline ahead, possibly to the 1000 level, as shown on the next 20-Year Weekly chart. Bulls will need to re-take 1300 and hold that level before we likely see any further serious commitment to, ultimately, reverse this long-standing downtrend on the weekly timeframe.

Volumes are very thin between 1100 and 1000, as shown in the Volume Profile along the right-hand side of the chart, so we could very well see 1000 re-tested before we see any significant buying enter the Gold market.

Volatility on SPX:VIX Ratio Pair at Critical Level

I last wrote about the SPX:VIX ratio in my post of August 15th. I mentioned that failure to hold above the 150.00 level would likely see a prior gap up filled, while a break and hold below the 110.00 level would likely see a larger-scale correction begin in equities.

Since that date, price on this ratio finally fell below 150.00 on September 22nd (after re-testing that level and rallying on a dead-cat bounce), as shown on the 20-Year Daily chart below, and closed today (Thursday) just above the 100.00 level (filling the gap in the process). This increase in volatility is not surprising after this ratio pair put in a massive outside bearish engulfing candle on the Monthly timeframe, as I had noted in my post of July 31st.

This 100.00 level sits at a 50% Fibonacci retracement level, taken from the lows (on this ratio pair) in 2008 to the all-time highs set in July of this year. We may see some further volatile swings around (or on either side of) the 100.00 to 110.00 levels for awhile until price either resumes its downtrend, or reverses and rallies. Since the Momentum indicator did not make a new low after today's plunge, we could see a bit of a bounce in equities before it becomes clearer as to which direction equity traders will favour.

Failure to hold the 100.00 level could see a lot of damage done to equities in short order...the bulls will have to begin buying with some heavy volumes to prevent such a scenario from playing out. In any event, volatile intraday swings will likely continue for some time to come...one chart to watch over the coming days/weeks.

Since that date, price on this ratio finally fell below 150.00 on September 22nd (after re-testing that level and rallying on a dead-cat bounce), as shown on the 20-Year Daily chart below, and closed today (Thursday) just above the 100.00 level (filling the gap in the process). This increase in volatility is not surprising after this ratio pair put in a massive outside bearish engulfing candle on the Monthly timeframe, as I had noted in my post of July 31st.

This 100.00 level sits at a 50% Fibonacci retracement level, taken from the lows (on this ratio pair) in 2008 to the all-time highs set in July of this year. We may see some further volatile swings around (or on either side of) the 100.00 to 110.00 levels for awhile until price either resumes its downtrend, or reverses and rallies. Since the Momentum indicator did not make a new low after today's plunge, we could see a bit of a bounce in equities before it becomes clearer as to which direction equity traders will favour.

Failure to hold the 100.00 level could see a lot of damage done to equities in short order...the bulls will have to begin buying with some heavy volumes to prevent such a scenario from playing out. In any event, volatile intraday swings will likely continue for some time to come...one chart to watch over the coming days/weeks.

Subscribe to:

Posts (Atom)