* See UPDATE below...

The following weekly chart of WTI Crude Oil shows that, from the day that President Biden took office on January 20, 2021, it has gained around 105%, to date...that has resulted in incrementally higher gasoline prices since then.

Russian President Putin declared war and invaded Ukraine on February 23. Since then, oil gained around 16%, as shown on the following daily chart...just a fraction of its overall gain since Biden became President and declared his own war on U.S. oil and gas drilling and production, as well as new pipelines.

You can see similar increases in RBOB Gasoline...104.59% from January 20, 2021 and 15.52% from February 23, as shown on the following weekly and daily charts, respectively.

Since the 'war segment' represents only a small portion of the overall increase, the bulk of the increase has occured since President Biden took office.

Much of the increase in oil and gasoline are a result of global ESG policies, exacerbated by the war in Ukraine, and will likely worsen over time and lead to a recession, according to this report.

These facts indicate that, after banning Russian oil imports into the U.S. on March 8, President Biden's attempts to blame high gas prices entirely on President Putin are erroneous.

Instead, the majority of these increases have happened since Day One of Biden's presidency.

As an aside, both Oil and Gasoline Futures topped out on March 7...the day before the ban.

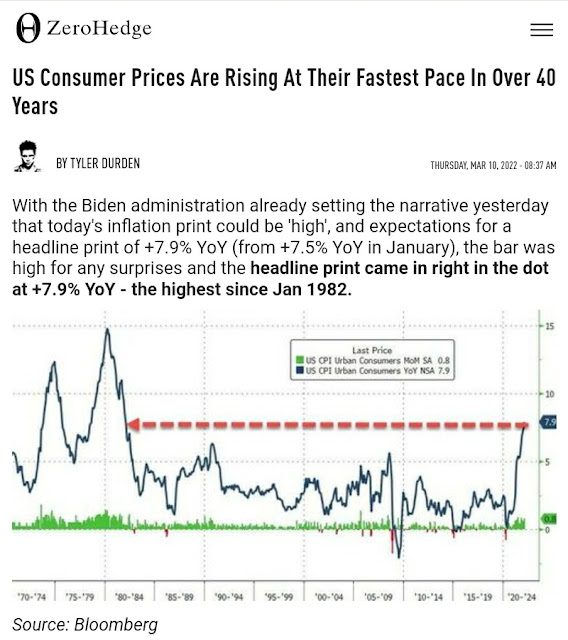

Inflation has risen to 7.9% YoY, to date...the highest since 1982.

Joe Biden's repeated claims that wages have kept up to the rate of inflation are also false, as noted below.

These are not the first occasions when Joe Biden has blatantly lied to Americans, and I doubt they will be the last. There are numerous examples sprinkled throughout my articles at this link.

* UPDATE March 11...

If you still think that inflation is "transitory," you will be in for a nasty surprise...this article spells out why it's not.

It looks like things will only get much worse from here. Global political and economic bifurcation has begun.