* See UPDATE below...

US Fed Chairman Jerome Powell emphasized several times during his press conference, following today's FOMC rate hike of 0.75% to 3.75%-4%, that the Fed is NOT pausing their rate hikes, as they're focused on raising rates until inflation comes back down to their target 2% rate..."It's premature to discuss pausing and it's not something we're thinking. That's really not a conversation to be had now. We have a ways to go."

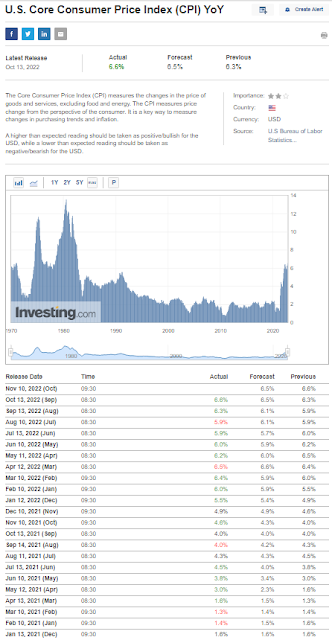

He referred to the US Core Consumer Price Index (CPI) YoY and US Core PCE Price Index YoY multiple times during the Q&A period. They are highly elevated at 40-year levels, as shown on the following graphs, and there is no hint they are falling any time soon...particularly as the costs of oil and gas show no signs of abating, and they affect the price of everything.

The SPX plunged 134.75 points from its high today of 3894.55 and closed at its low of the day at 3759.69.

So, in spite of the constant barrage of "We think the Fed's going to pause or pivot, soon..." from TV analysts and pundits, it seems that the Fed ignored all of that rhetoric, once again, to focus on their job of reducing inflation.

How many times will these talking heads cry wolf? And, how many times will the market take their bait?

As long as that scenario keeps repeating itself, ad nauseam, we'll continue to see "Dead Cat Bounces" occur in the SPX bear market...as well as volatile whipsaw intraday swings.

* UPDATE Nov. 6...

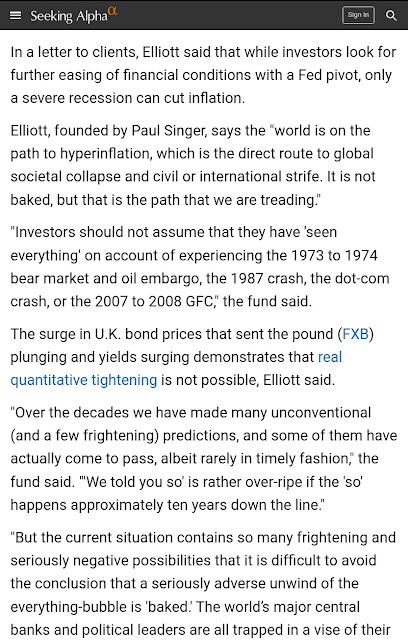

What happens when bad news is bad news?...🤔