* See UPDATE below...

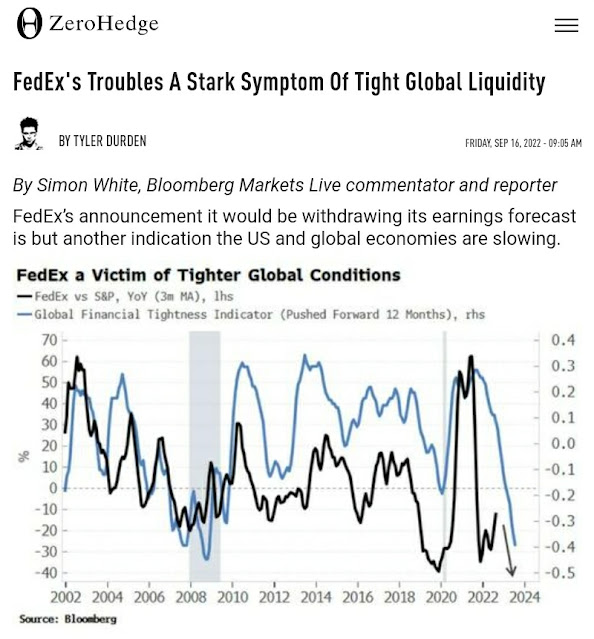

Following Thursday's after-hours dire world-wide recession warning by FedEx CEO, its stock (FDX) has plunged this morning.

FDX has a history of volatile parabolic spikes and plunges. In fact, it had difficulty, twice, in holding any gains above 120.00 since it broke above in September 2013, as shown on the following monthly chart. Price is heading back to that level for a third time, as I write this post.

A drop and hold below 120.00 could see it hit its next major support level of 80.00, or lower.

If this is a harbinger of things to come, it will confirm that world markets are in for a very rough ride (as I first reported on July 26 and later updates).

* UPDATE Sept. 19...

It seems to me that markets have 'levitated on myths' since Day One, especially since March 2009, in the weeks, months and years following the 2008/09 financial crisis.

Fed Chairman Powell can't fix the global supply chain crisis, so his rate-raising actions won't curb inflation entirely, but will contribute to the giant economic mess that countries around the world now find themselves trying to overcome.

People, especially those on fixed and low incomes (and even middle incomes), are in for a lot of pain...thanks to the artificial market and economic environment that global central bankers have created over many years.

In other words, visualize the proportionality of 'cause and effect' and you get the picture.

Abraham Maslow (Maslow's Hierarchy of Needs) would be rolling in his grave if he saw the state of things now.

Most people (99%) around the world are still struggling in the bottom two levels of the Hierarchy.

So much for so-called 'personal progress' over the centuries! 🤔