* See UPDATES below...

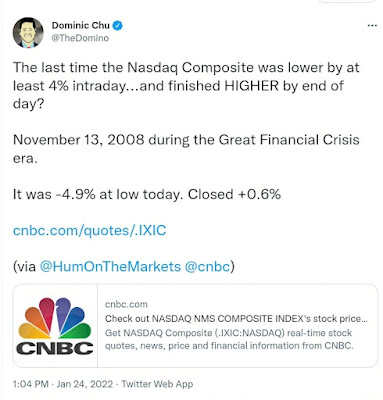

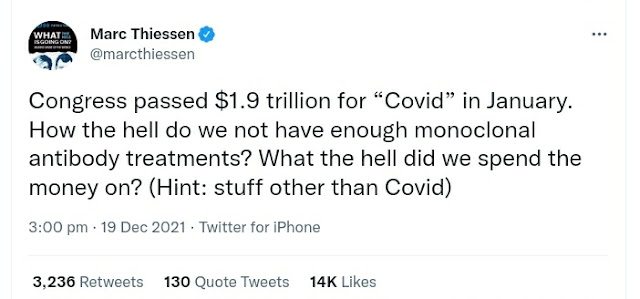

Good question, Ari...and it's one that others are also asking.

I'd also ask why he didn't organize a task force to launch an "Operation Warp Speed" to produce these test kits, as well as develop and produce theraputics, such as the "Operation Warp Speed" program ordered by former President Trump to research and produce vaccines for COVID-19?

He's had months to do so, but sat on it instead. Why?

Add these to the many crises and failures of President Biden's first year in office...which started on Day One when he signed executive orders banning new oil and gas exploration and drilling on federal lands and cancelled the Keystone XL pipeline already well under construction from Canada, which led to an increase in the price of WTI Crude Oil from 48.52 (at the December 2020 close) to a high of 85.41 this year.

Of course, this higher cost ended up negatively affecting the costs of all goods and services and contributed to the inflationary numbers we're seeing today.

Until Biden reverses these orders, inflation will remain high, with energy shortages becoming the norm...quite the reversal from the energy independence and low oil and gas prices that Americans enjoyed, for the first time, by the end of Trump's presidency, thanks to his policies.

Furthermore, until President Biden reverses his prior executive order which cancelled the completion of the wall which was well under construction (by the Trump administration) along the southern border of the country when he first took office, the U.S. will continue importing new COVID-19 cases and new variants via the thousands of illegal aliens who are entering every day...around 2 million did so already in 2021, and most of them were unvaccinated. There is no requirement by the Biden administration that they be vaccinated before being allowed to remain in the country, unlike the thousands of Americans who wish to work and eat at restaurants, etc...which is also contributing to supply chain shortages, worker and healthcare shortages, and inflation.

No wonder most Americans are suffering under his policies, which are negatively impacting national security, inflation, and the national debt, etc.

With three more years remaining under Biden's presidency, I doubt things will get any better any time soon...rather, quite the opposite, so brace yourselves.

* UPDATE January 11...

It looks like it's too late for President Biden to get a grip on the COVID-19 crisis...he failed to act in a timely manner...

Meanwhile, his top advisor, Dr. Anthony Fauci, has some serious explaining to do regarding the origins of COVID-19...

And, there's this...

Americans...and the rest of the world...deserve truthful answers, once and for all...on a number of issues related to the pandemic, not just on the origins.

I've no doubt they will get them, in due course...as is beginning to be released by the US CDC...

* UPDATE January 12...

* UPDATE January 13...

* UPDATE January 14...

Good question, Glenn...why are Democrats, including Joe Biden, protecting Russia's energy supply...while hamstringing America's oil and gas supply?

And, why did they use the fillibuster to block this bill on the same day that Biden was criticizing members of his own party for not supporting ending the fillibuster rule so he could get his voting rights agenda passed in the Senate?

It's all very nonsensical and hypocritical.

More bad news for Dr. Fauci, and, by extension, President Biden, regarding the origins of COVID-19, its funding, and the early findings on theraputics...

ZeroHedge excerpt

* UPDATE July 21...

Oops!...more awkward Biden bloopers...he's had 2 vaccination shots and 2 boosters...but still got COVID-19...in spite of his prior declarations that the virus was a "pandemic of the unvaccinated"...

* UPDATE July 23...Shameful bald-faced lies by Dr. Birx and Dr. Fauci have now been exposed regarding COVID-19, vaccines and the virus origin, as well as suppression of free speech.

Who are we supposed to trust anymore to tell the truth about viruses and vaccines? 😕

What are the penalties for these lies and suppression of free speech??? 🤔

* UPDATE Aug. 17...

Perhaps if the CDC concentrated on studying and publishing actual scientific facts, instead of politicizing theories, speculations, fabricated 'facts' (lies) and orders from their political boss (President), they'd provide adequate and appropriate health protection, guidance and services for the public in the future...but, don't hold your breath that it will operate that way any time soon, inasmuch as the Biden administration has its political finger on the scale of everything.

* UPDATE Sept. 18...

So, what else is new?...Is anyone surprised?

* UPDATE Oct. 12...

Another blatant lie exposed -- this time exposing Pfizer -- which was repeated by Dr. Fauci and President Biden.

It's a doozy, which, no doubt, cost thousands of people their jobs who refused to get Biden's mandated jab!

Where is the accountability and what are the repercussions for all their lies?

COVID discriminations didn't occur only in America.

Canada was plagued with its share of unprecedented mandates and discriminations...by its political leaders, under the influence of their health advisors.

With a change in leadership, hopefully these will eventually be resolved to everyone's satisfaction and the wrongdoings will be made right.

It truly was/is the worst of times!

ZeroHedge excerpt

* UPDATE Oct. 19...

This disturbing disclosure by Moderna makes me wonder why people were forced to take their original 2-dose COVID-19 vaccine in the first place, or be fired from their jobs, or prohibited from accessing other services and travelling, etc.

There are a lot of things about all of this that don't make sense. Hopefully a new Congress will investigate all of these issues in the new year.

* UPDATE Nov. 2...

So...forgive and forget?

Somehow, I don't think that will catch on...too many lies were told and too many lives were (and are being) ruined. 😕

* UPDATE Feb. 26, 2023...

So, which U.S. government agency will flip its conclusions, next, about the origins of COVID-19?

The Energy Department joins the FBI and others in concluding that the pandemic most likely arose from a virology lab leak in Wuhan, China.

* UPDATE March 1...

The FBI Director has now confirmed, in a Fox News TV interview and in a tweet, that the origins of COVID-19 "most likely" came from the Wuhan lab in China, as outlined in the following Zerohedge article.

Americans are now waiting for President Biden to make the same public declaration...and outline what steps he will take to ensure that this does not happen again, as well as what consequences will befall the Chinese government from this world-wide health and economic catastrophy.

* UPDATE March 6...

It seems that CNN (and other news agencies...except Fox News) are more intent on making up "so-called news" than actually investigating stories and events properly and reporting the facts.

No wonder the Nielsen TV ratings consistently put them in last place!

Nothing has changed at CNN under new management, inasmuch as their reporting is still not credible.

The following Fox News TV show aired yesterday and contained eye-opening information relating to the origins of the COVID -19 virus...

* UPDATE March 18...

The truth is beginning to emerge, regarding negative (and sometimes permanent or, even, deadly) side effects of the COVID-19 vaccines...

* UPDATE May 18...

Even the Pentagon, by its findings, has put to rest the claim by Dr. Fauci that COVID-19 originated in nature...

* UPDATE September 12...

So, who paid off these CIA investigators and why?

What is the Biden administration trying to hide from the public?

~~~~~~~~~

Judging by the revelations of blatant lies told by Dr. Birx and Dr. Fauci regarding COVID-19, it seems like the following ability is not limited to Joe Biden!